Our annual Giving Campaign inspired me to get involved more in the community.

- Stephanie

Simply put, because it’s the right thing to do. As a market leader in financial advice for over 90 years, IG Wealth Management has a unique responsibility to foster financial wellness among Canadians. Our national presence and deep-rooted commitment to the communities we serve are integral to our identity.

Our IG Empower Your Tomorrow platform is more than just a program; it’s a mission to equip Canadians with the tools, resources and confidence they need to take charge of their financial futures and improve their financial well-being. We focus on four underserved communities: Indigenous Peoples, seniors, youth and newcomers. We believe that financial understanding (coupled with the right resources and skills) empowers Canadians to reach their goals and build a healthier, brighter future for themselves, their families and their communities.

We believe in direct engagement with the communities we serve and partnering with reputable, well-vetted non-profit organizations. We also focus on working with our partners to develop rigorous metrics that measure true impact and ensuring our employees and Advisors have the opportunity, whenever possible, to get directly involved. As an Imagine Canada-certified company, we contribute 1% of our pre-tax profits every year to support charitable and not-for-profit organizations across Canada.

raised for United Way agencies through our 2023 employee and Advisor Giving Campaign.

employee and Advisor donations matched by IG to amplify impact.

paid volunteer hours available per year.

Our annual Giving Campaign inspired me to get involved more in the community.

- Stephanie

The impact one team volunteer day made, rippled out in so many directions, to so many people. My heart grew three sizes.

- Tracey

First Nations members who obtained one-on-one support and attended financial literacy workshops.

in income returned to First Nations members through tax filing support.

increase in financial confidence among newcomers engaged in our money management programs.

improvement in budgeting skills among newcomers engaged in our money management programs.

increase in financial decision-making among youth who complete our Money and Youth workshops.

I learned about resources in Winnipeg to manage money. Now working, I share this knowledge with co-workers and community.

- Zeenat

The workshop helped me understand the costs of living alone and how to budget and save for them.

- Youth

donated annually to over 300 local, grassroots organizations across Canada through IG region offices.

raised nationally by walkers in over 200 communities from coast to coast since IG became the title sponsor of the IG Wealth Management Walk for Alzheimer’s.

Teamwork made our two charity initiatives possible. We loved using our community support dollars together.

- Carey

I honour my Dad who had Alzheimer’s and loved to walk. Now I walk for him every year to support the Alzheimer’s Society.

- Kelly

IG has committed $5 million to support partnerships and initiatives for financial wellness in Indigenous communities across Canada. We’ve partnered with organizations like Prosper Canada, AFOA Canada, Pathways to Education, RRC Polytech and more, providing education, job training, scholarships and support to thousands of Indigenous families.

There are more than 600,000 Canadians living with dementia today and that number is expected to double in just 10 years. IG is a proud national partner of the Alzheimer Society and the national sponsor for the IG Wealth Management Walk for Alzheimer’s, the largest fundraising event for the Alzheimer Society.

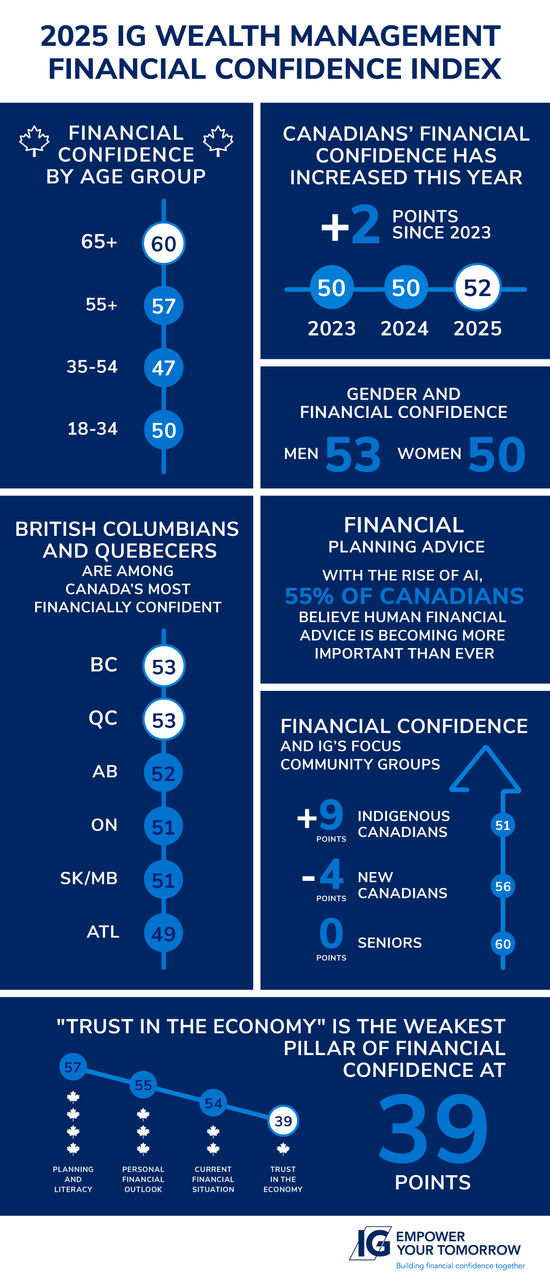

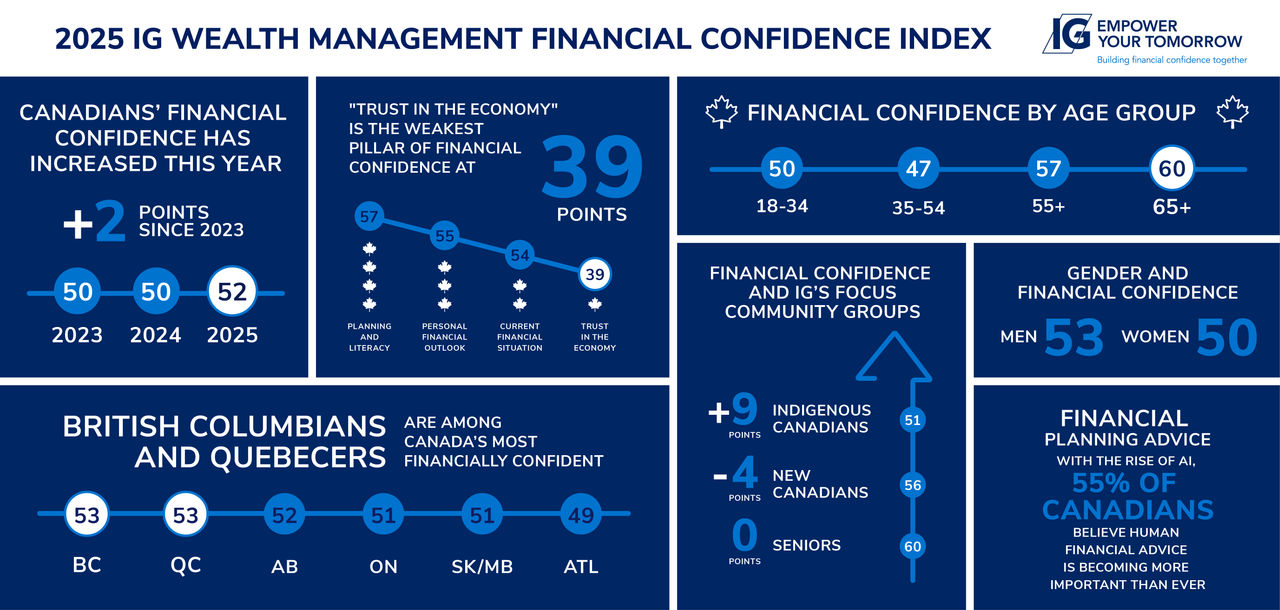

The IG Financial Confidence Index tracks and reports on Canadians' overall financial confidence by examining IG’s Four Pillars of Financial Confidence: Current Personal Financial Situation, Personal Financial Outlook, Planning and Literacy and Trust in the Economy.

This year’s Index score (52) rose above the historical average (51) for the first time since 2021, revealing an interesting paradox. Despite widespread concerns about the global economy, political instability and affordability, Canadians are showing a surprising degree of optimism and self-reliance when it comes to their personal finances.

Among IG’s four priority community groups, Indigenous Canadians’ confidence saw a significant rise of nine points this year, while seniors remained steady at 60 points and newcomers to Canada decreased four points, confirming why we continue to focus on building financial confidence among these groups.

At IG Wealth Management, we proudly partner with a diverse range of organizations, each contributing

to the financial well-being of Canadians. Together, we are building stronger communities.