Making sure you cover all the bases of real retirement planning

There’s so much more to real retirement planning than simply growing investments. A true retirement plan takes into account the retirement lifestyle you want and how much you’ll need, inflation and life expectancy risks, managing debts, and a tax-efficient plan for retirement income.

Strategies to consider when beginning to plan your retirement

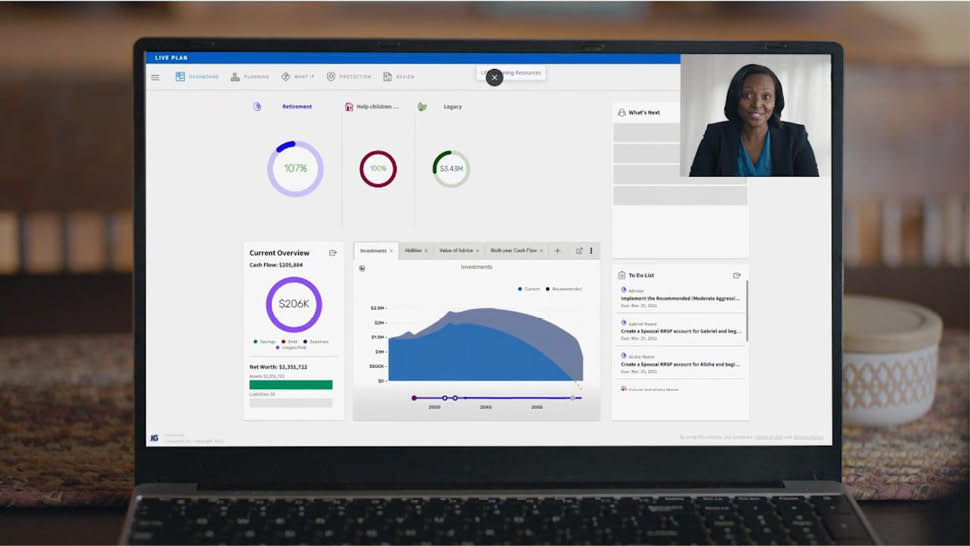

Want a real retirement plan?

Speak to an IG Advisor