How to use the Tax Centre

Visit the Tax Centre in Online Access to find receipts and reports you need for filing your annual tax return.

How to find the Tax Centre

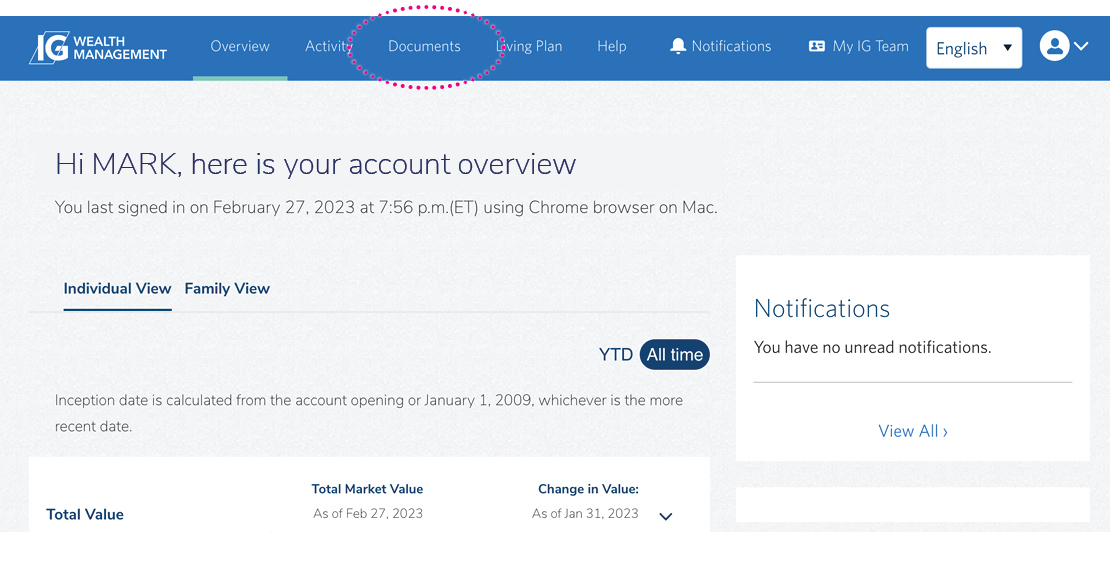

Sign in to Online Access using your username and password.

From the Overview page, click on Documents in the main menu (i.e., the blue bar at the top of your screen).

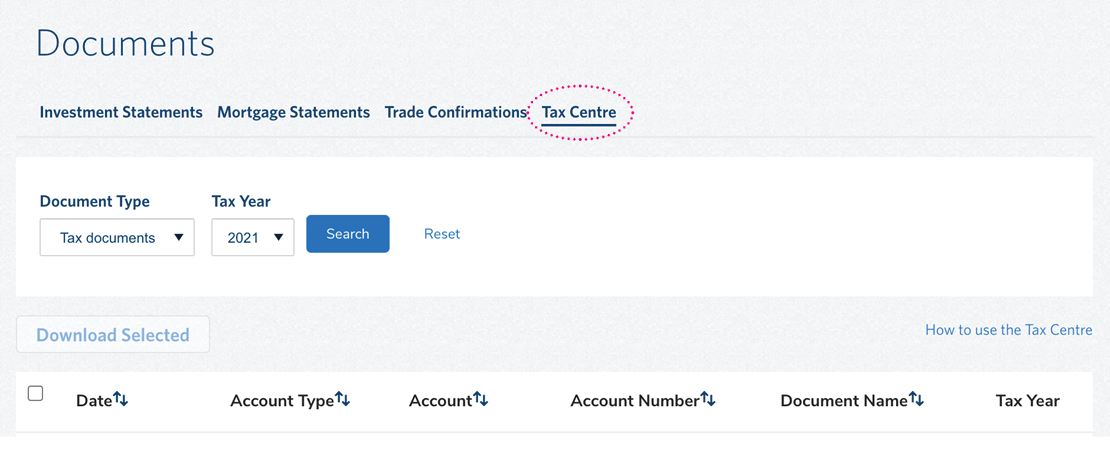

On the Documents page, click on Tax Centre.

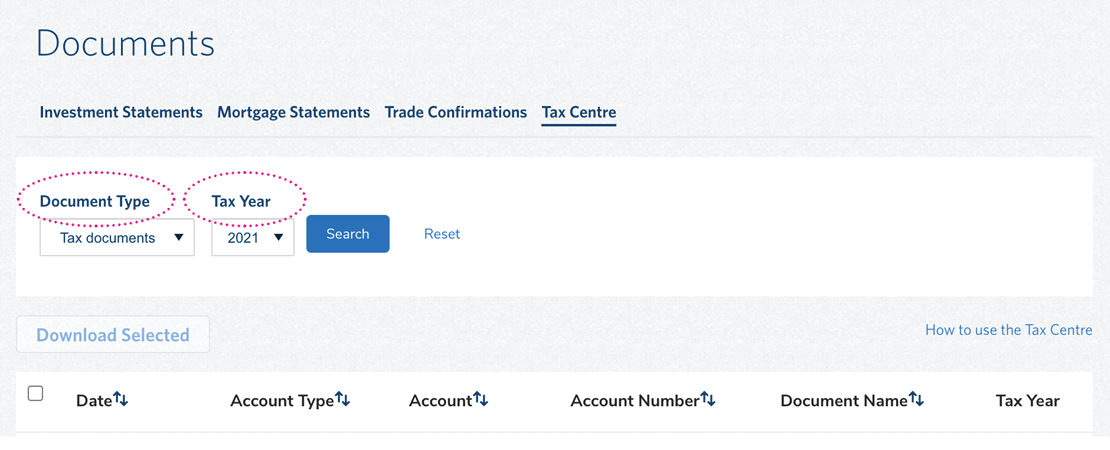

You will see two drop-down menu boxes: Document Type and Tax Year. Using these menus, you can select documents to review, download or print.

How to access your tax slips

To access your tax slips, select “Tax Documents” from the Document Type menu, choose a Tax Year and click the Search button to bring up a list of tax slips for the year in question. Up to seven years of tax slips are available.

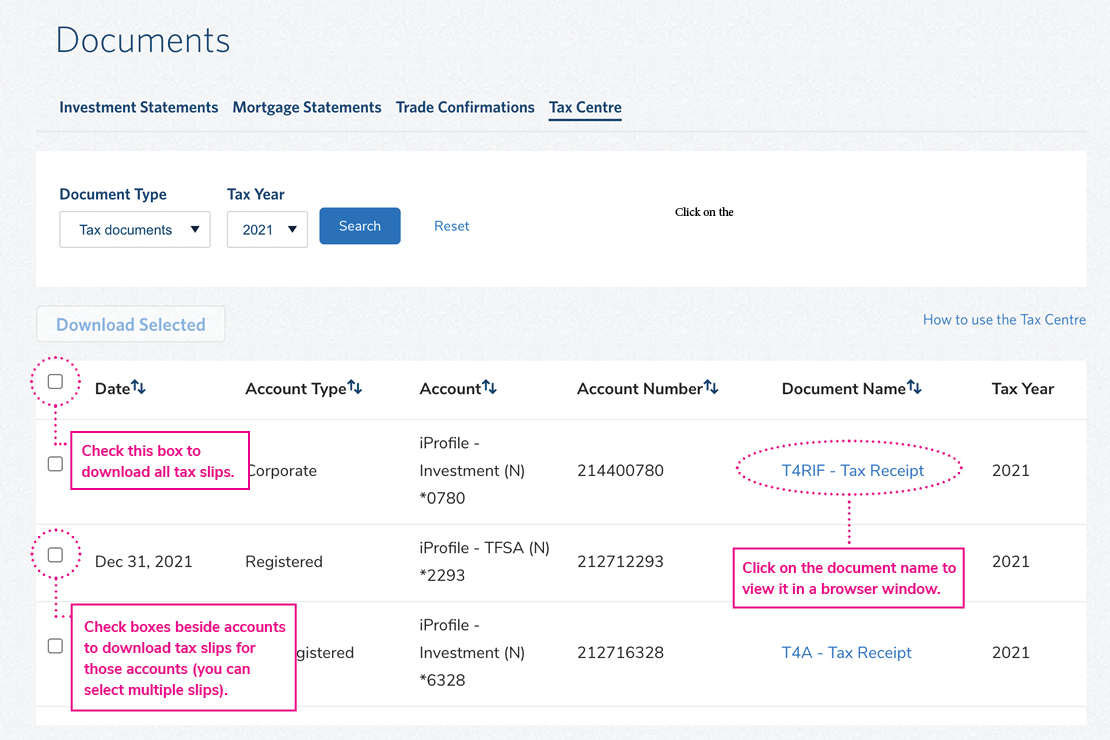

To view and/or print a particular tax slip, click on the description of the slip (in blue text) under Document Name. Doing so will open an image of the slip in a new browser tab or window. If you wish to print the slip, you can do so from that browser window.

To download your tax slips (i.e., save them to your computer), select the slips you wish to download using the check boxes on the left side. To download all your slips, click the box next to the Date heading. Then click the Download Selected button and your sips will be saved to the Downloads folder on your computer (as PDF files).

How to access your Realized gain/loss reports

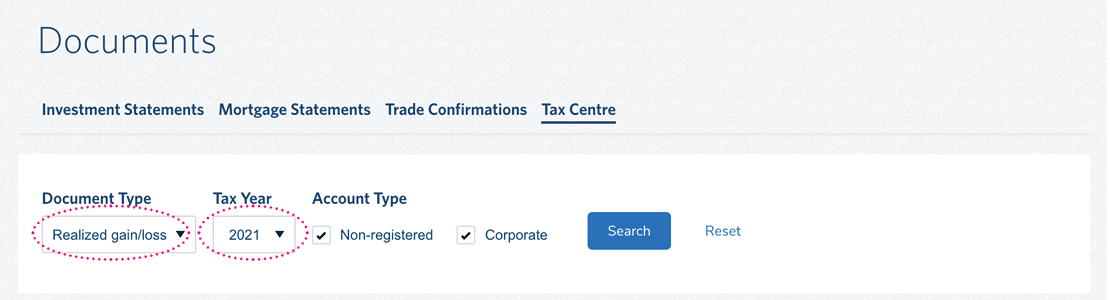

To access Realized gain/loss reports for your non-registered and corporate accounts, select “Realized gain/loss” from the Document Type menu and select the Tax Year for which you wish to see this report. Then click the Search button. Note that Realized gain/loss reports are only available from 2021 forward.

You can also filter by “Non-registered” and “Corporate” account types by clicking on those boxes under the Account Type menu. Note that Realized gain/loss reports are not available for registered accounts.

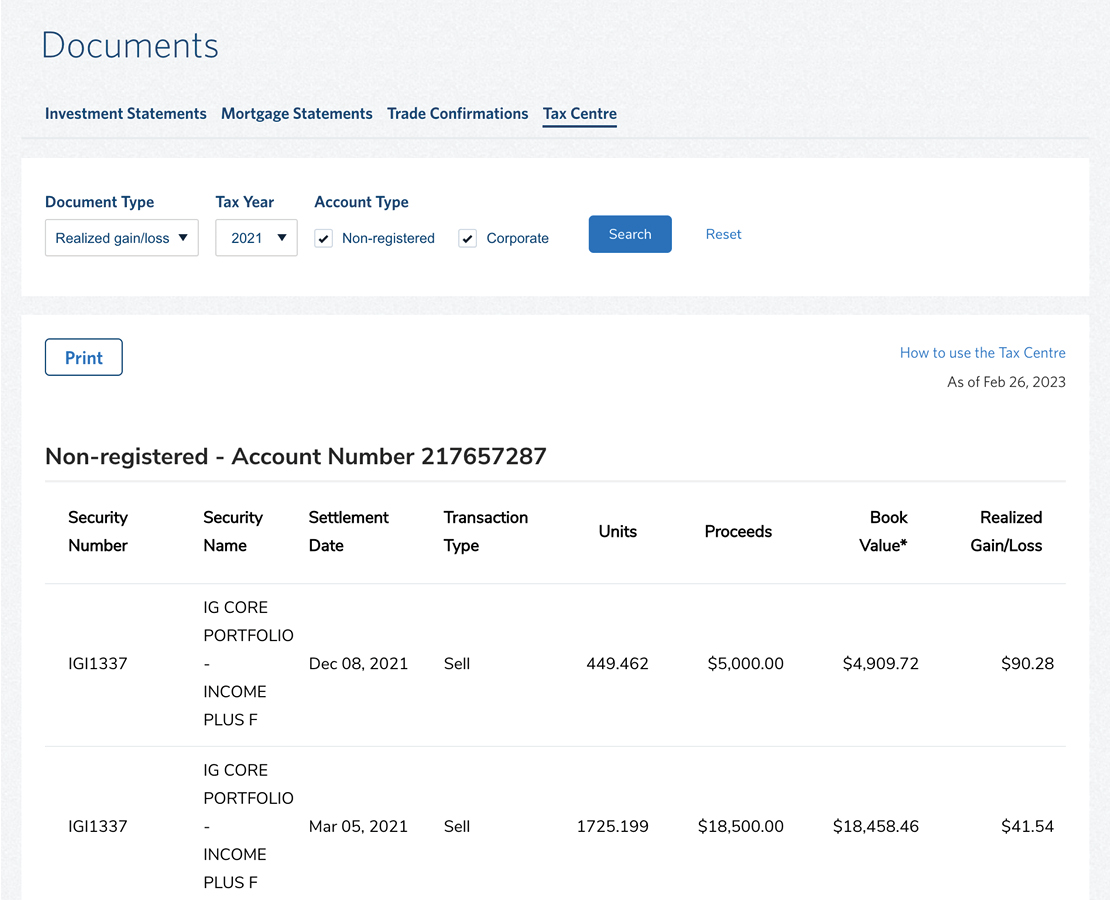

The Realized gain/loss report(s) for the selected account types will appear on your screen (with each account identified by its Account Number).

To print the Realized gain/loss report, simply click the Print button. This will open a print menu from which you can print a paper copy on a connected printer or save the report on your computer as a PDF by selecting PDF from the Printer drop-down menu.

How to access your Annual summary of advisory fees

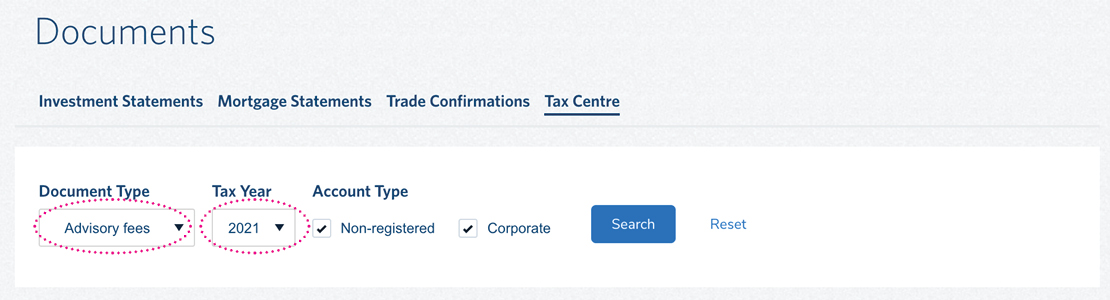

To access your annual summary of advisory fees for your non-registered and corporate accounts, select “Advisory fees” from the Document Type menu and select the Tax Year for which you wish to see this report. Then click the Search button. Note that Advisory fee reports are only available from 2021 forward.

You can also filter by “Non-registered” and “Corporate” account types by clicking on those boxes under the Account Type menu. Note that Advisory fee reports are not produced for registered accounts.

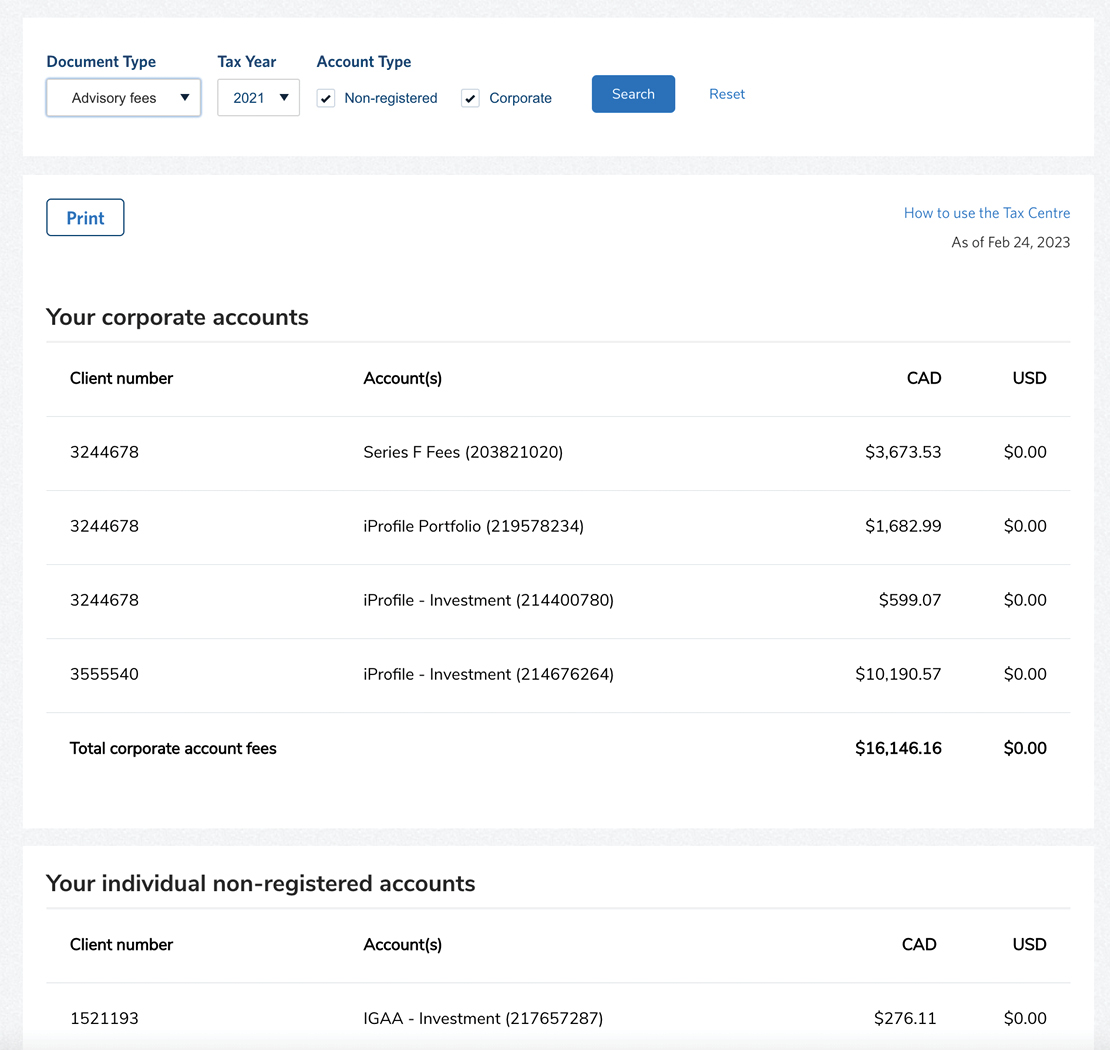

The Advisory fee report(s) for all selected account types will appear on your screen (with each account identified by its Account Number).

To print the Advisory fee report, simply click the Print button. This will open a print menu from which you can print a paper copy on a connected printer or save the report on your computer as a PDF by selecting PDF from the Printer drop-down menu.