Franklin ClearBridge Canadian Equity

Mandate commentary

Q3 2025

Highlights

① The mandate’s strong absolute returns in the third quarter of 2025 were driven primarily by the portfolio’s allocations in the financials, materials and energy sectors.

② Balancing geopolitical uncertainty with positive economic fundamentals.

③ Broad diversification remains the best way to handle mixed market conditions.

Mandate overview

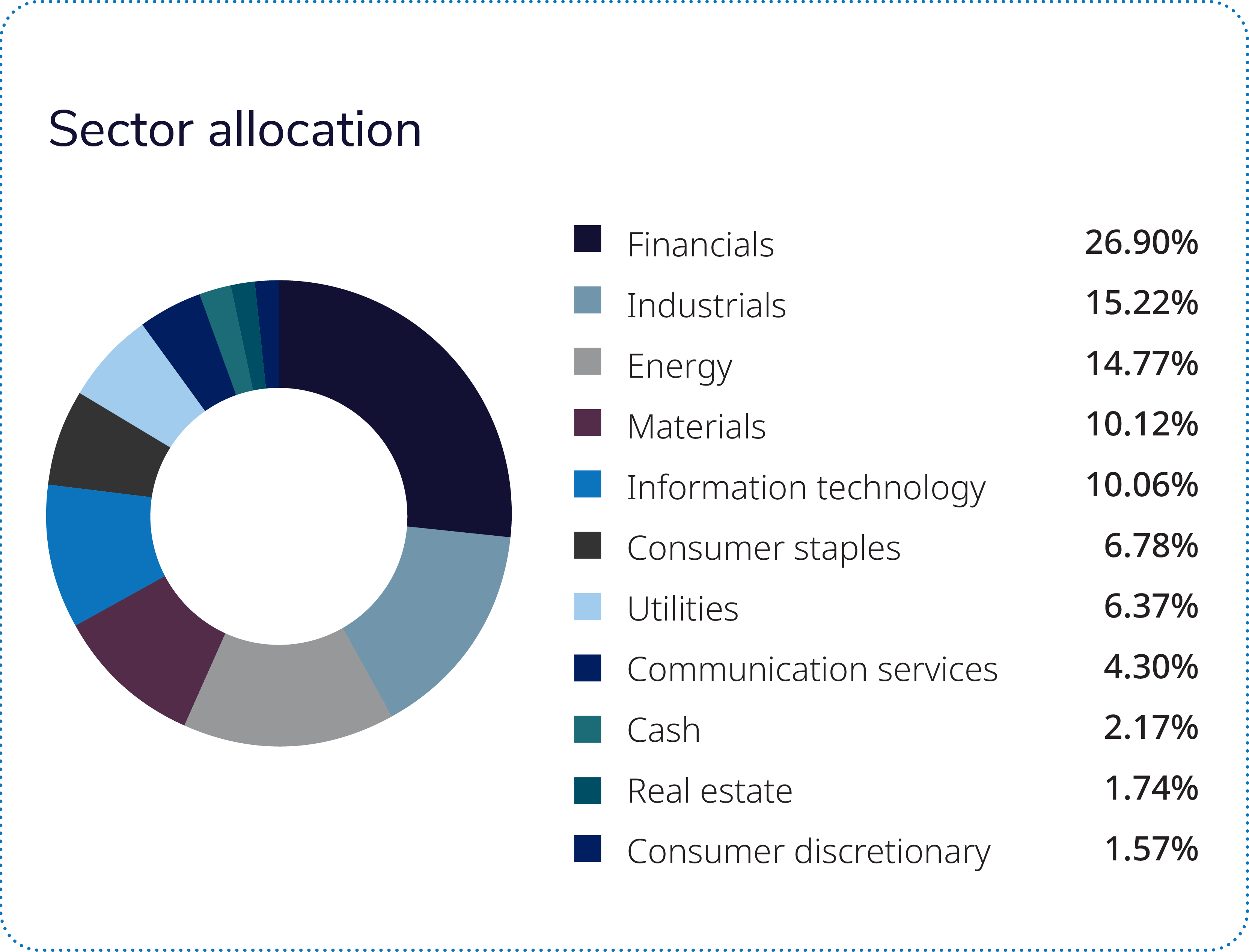

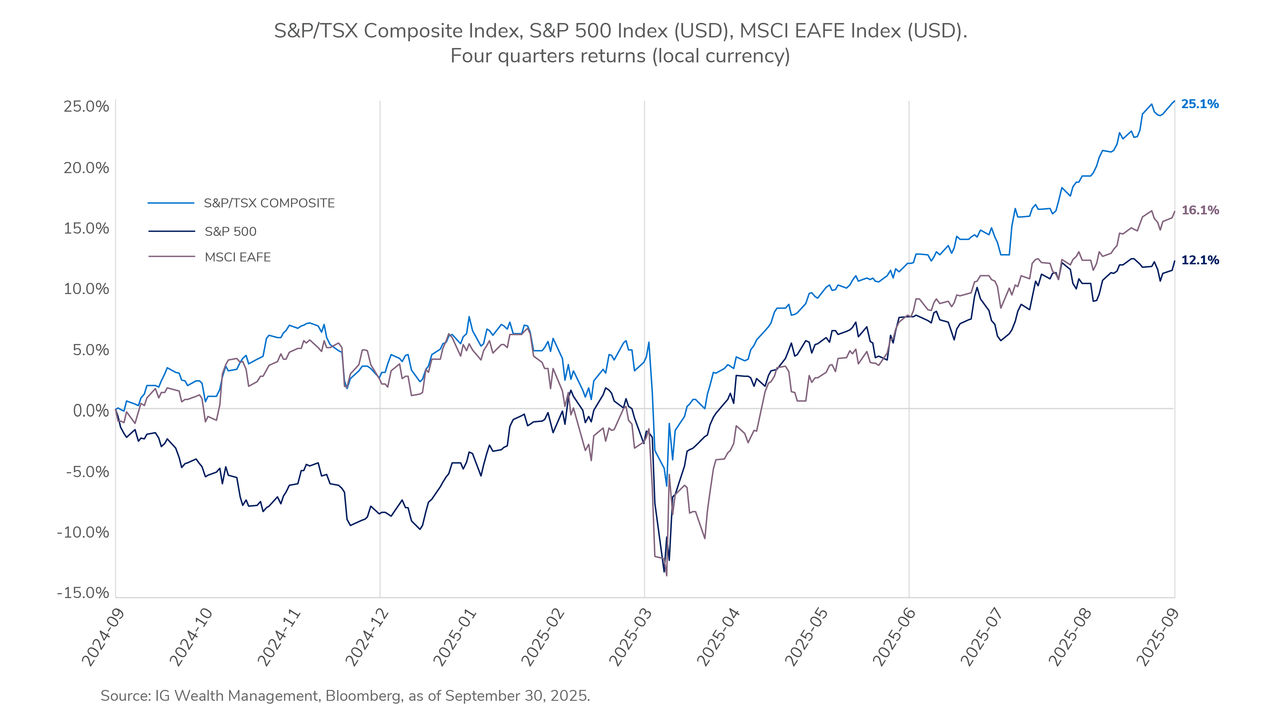

Despite strong absolute returns, the mandate underperformed the 12.5% third quarter return of the S&P/TSX Composite index. Primary detractors included poor sector allocation in materials, industrials and consumer staples, as well as poor security selection in energy and materials. This was partially offset by the positive contribution from security selection within the financials and consumer staples sectors.

Despite strong absolute returns, the mandate underperformed the 12.5% third quarter return of the S&P/TSX Composite index. Primary detractors included poor sector allocation in materials, industrials and consumer staples, as well as poor security selection in energy and materials. This was partially offset by the positive contribution from security selection within the financials and consumer staples sectors.

Gold’s “safe haven” status continued to shine this year, in the face of a weakened U.S. dollar. This resulted in the materials sector in Canada delivering the strongest returns in the last quarter. The mandate’s underweight position detracted from relative performance.

Mandate: Positioned for market risk

Performance contributors

Constellation Software: being underweight to one of the leading Canadian technology firms added the most value from a single security standpoint.

Franco-Nevada: the overweight position in the leading royalty-based gold producer added the second most value from a single security standpoint.

Performance detractors

Materials sector: the underweight position due to the lack of exposure to some of the large-cap fully valued gold producers detracted the most.

Canadian National Railway: the overweight position was the largest single security detractor, excluding gold producers. Due to economic slowdown.

Total gross returns:

Total return | QTD | YTD | 1YR | 3YR | 5YR | since INC. (NOV. 14, 2016) |

FRANKLIN CLEARBRIDGE CANADIAN EQUITY | 8.63%

| 10.77%

| 20.35%

| 16.57%

| 15.95%

| 10.80%

|

Mandate repositioning

Trading activity in the mandate picked up, as the environment provided compelling opportunities to both scale into and pare back positions. The mandate selectively increased exposure to several out-of-favour cyclical stocks that faced significant pressure, while at the same time trimming resilient defensive sectors, including consumer staples and utilities.

Portfolio construction carefully considers concentration, diversification and potential correlations to ensure resiliency in the current environment. The emphasis is on predictability and downside protection, while maintaining reasonable valuations. This approach supports portfolio stability during periods of market volatility, while allowing flexibility to capture opportunities.

Market overview: signs of optimism emerge, despite the noise during "Liberation Day" fallout

The third quarter delivered broad gains across asset classes, with market performance largely overriding a backdrop of cautious sentiment. Investors looked past persistent trade policy headlines, increasingly treating the U.S. administration's tariff policy as noise rather than a core risk. The primary catalysts for the positive performance were a subtle shift toward lower-interest-rate expectations and resilient corporate earnings.

Signals from the U.S. Federal Reserve of imminent rate cuts were followed by a quarter percentage cut in September. Government bond yields eased into the quarter's end, supporting bond prices, while corporate bonds outperformed government bonds.

Market outlook: solid reasons for optimism, despite ongoing uncertainty

Looking ahead, the normalization of inflation is a key development, providing central banks with the flexibility to begin an easing cycle over the next six to 12 months. This anticipated shift toward more accommodative monetary policy is expected to lower borrowing costs, creating a supportive foundation for economic activity.

This should help the macroeconomic environment sustain corporate strength. Earnings are projected to remain robust, building on a consistent trend of exceeding expectations. Resilient corporate profitability continues to be a primary driver of market performance.

The combination of impending rate cuts and durable earnings growth establishes a constructive outlook for equities. This environment reinforces the principle that focusing on underlying fundamentals, rather than reacting to short-term market volatility, is a prudent strategy for capturing future growth potential.

To discuss your investment strategy, speak to your IG Advisor.

Azure Managed Investments™ provides discretionary investment management services distributed by IG Wealth Management Inc., Investment dealer. We will manage your Azure Managed Investments Accounts on a segregated basis in accordance with your investment policy statement and the resulting mandate selected by you. Mandates will be managed by I.G. Investment Management, Ltd. and partner organizations. You are required to make a minimum initial investment of $150,000; please read the Azure Managed Investment Account Agreement for complete details, including fees and expenses.

This commentary may contain forward-looking information, which reflects our or third-party current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed herein. These risks, uncertainties and assumptions include, without limitation, general economic, political and market factors, interest and foreign exchange rates, the volatility of equity and capital markets, business competition, technological change, changes in government regulations, changes in tax laws, unexpected judicial or regulatory proceedings and catastrophic events. Please consider these and other factors carefully and do not place undue reliance on forward-looking information. The forward-looking information contained herein is current only as of September 30, 2025. There should be no expectation that such information will in all circumstances be updated, supplemented or revised, whether as a result of new information, changing circumstances, future events or otherwise.

This commentary is published by IG Wealth Management. It is provided as a general source of information. It is not intended to provide investment advice or as an endorsement of any investment. Some of the securities mentioned may be owned by IG Wealth Management or its mutual funds, or by portfolios managed by our external advisors. It may contain certain forward-looking statements regarding the market conditions which are based upon assumptions believed to be reasonable at the time of publishing. Every effort has been made to ensure that the material contained in the commentary is accurate at the time of publication, however, IG Wealth Management cannot guarantee the accuracy or the completeness of such material and accepts no responsibility for any loss arising from any use of or reliance on the information contained herein.

Past performance may not be repeated and is not indicative of future results. Actual performance may vary due to a range of factors including but not limited to current market conditions, timing of contributions and withdrawals, client-imposed restrictions, fees, expenses, tax considerations and other individual circumstances. There are no assurances that any mandate will achieve its objectives and/or avoid any losses.

Trademarks, including IG Wealth Management and IG Private Wealth Management, are owned by IGM Financial Inc. and licensed to subsidiary corporations.