Portfolio returns: Q4 2025

| Total Return | 1M | 3M | YTD | 1YR | 3YR | 5YR | 10YR | Since Inc. (Apr 11, 2022) |

IG U.S. Taxpayer Portfolio – Global Fixed Income Balanced F | -0.69

| 0.55

| 7.37

| 7.37 | 8.11

| 5.29

| ||

Quartile rankings | 2 | 3 | 2 | 2 | 2 |

| Total Return | 1M | 3M | YTD | 1YR | 3YR | 5YR | 10YR | Since Inc. (Apr 11, 2022) |

IG U.S. Taxpayer Portfolio – Global Fixed Income Balanced F | -0.69

| 0.55

| 7.37

| 7.37 | 8.11

| 5.29

| ||

Quartile rankings | 2 | 3 | 2 | 2 | 2 |

The IG U.S. Taxpayer Global Fixed Income Balanced Portfolio underperformed its benchmark over Q4 2025.

The IG U.S. Taxpayer Global Fixed Income Balanced Portfolio underperformed its benchmark over Q4 2025.

Asset allocation positioning was positive over the quarter. Modest overweight positions in Japan and EAFE equities were positive for active performance over the quarter. Country-relative value positioning was modestly negative over the quarter, driven by underweight positions in Germany and Switzerland. Overweight positions in the U.K., Spain and Poland were additive. Sector rotation in U.S. equities was flat, as overweight positions in industrials and communication services were additive, while an underweight position to financials detracted.

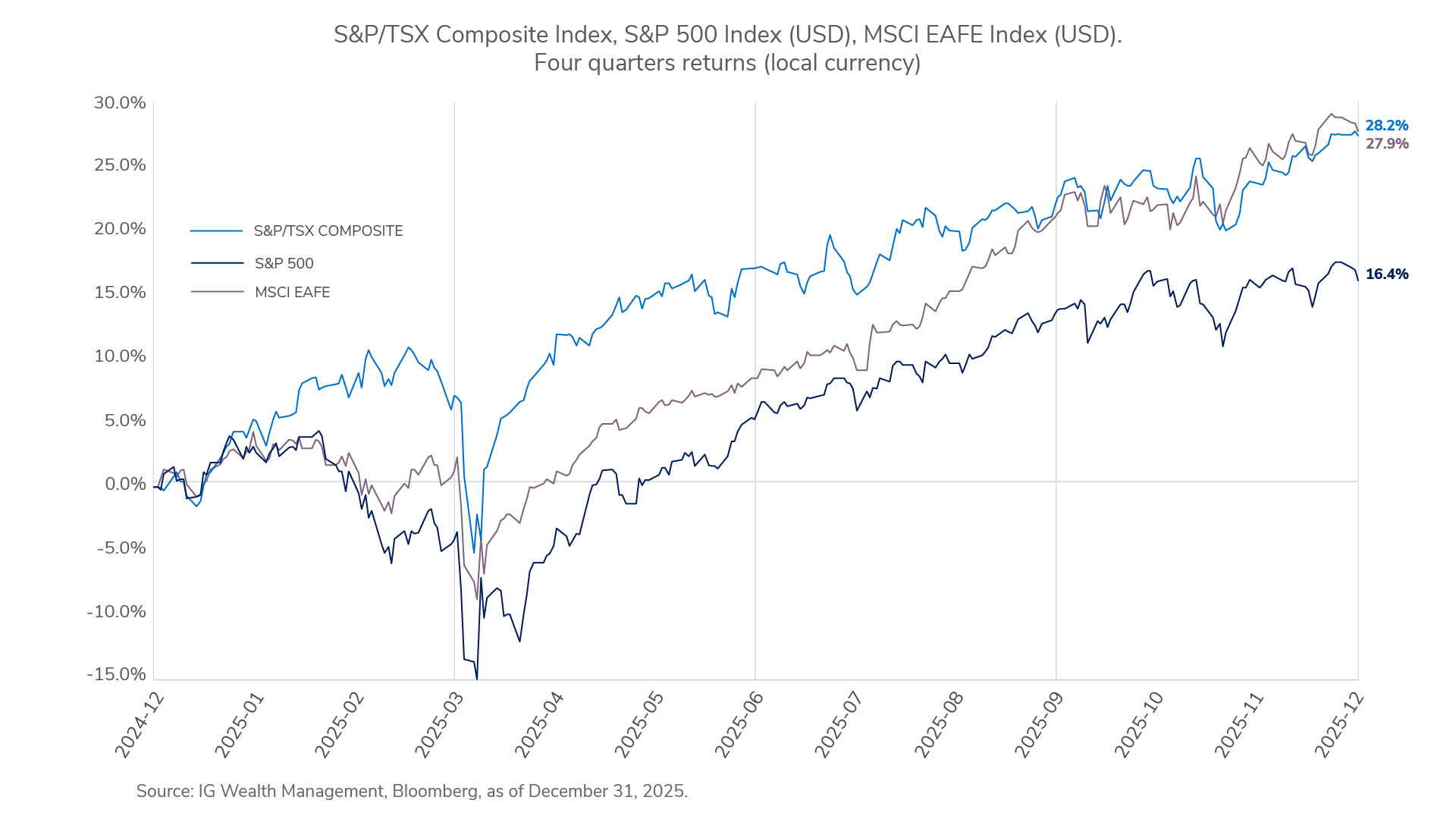

Markets ended the fourth quarter of 2025 on a strong note, capping a year defined by resilience and broad-based gains. Equities led performance, as investors looked beyond policy noise and focused on improving fundamentals. Global markets advanced, supported by steady corporate earnings, easing inflation pressures and a clear shift toward lower interest rates. Canada outperformed most developed peers, driven by strength in materials and financials, while European and Asian markets rebounded on firmer trade activity and renewed investor confidence. In the U.S., equity performance remained positive, led by technology and communication services, with improving breadth across sectors signalling a healthier market foundation.

Fixed income delivered modest but positive returns, as central banks continued to ease policy. Government yields declined on the short end while longer maturities remained stable, allowing coupon income to drive returns. Credit conditions stayed firm, underscoring the strength of corporate balance sheets entering 2026.

In 2025, we saw two distinct U.S. policy phases. Early in the year, U.S. policy was a source of volatility through tariffs, immigration measures and DOGE-related actions. In the second half, policy shifted toward calming markets, and investors embraced the idea that U.S. policymakers would “run the economy hot” to support asset prices and onshore critical industries. Alongside increased defence and security spending globally, this drove a broad rally in the second half of the year, with equities, bonds and the U.S. dollar all performing well. We believe the limits of “run it hot” policies are becoming clearer: governments are increasingly prioritizing national security, supply-chain resilience and re-industrialization over market efficiency, using tools such as tariffs, subsidies, defence spending and direct stakes in strategic industries. At the same time, central banks appear less willing to support markets through large-scale bond buying, focusing instead on policy rates and short-term liquidity. These shifts point to a less supportive environment for broad risk-taking and greater vulnerability to volatility.

Despite significant policy support, U.S. industrial production remains below pre-pandemic levels, with weakness spreading to consumers, housing and manufacturing employment. With U.S. growth and cyclicals priced optimistically, we see more attractive, underappreciated opportunities outside the U.S. — particularly in Japan and parts of Europe — where growth, inflation dynamics and fiscal support are more favourable.

Commissions, fees and expenses may be associated with mutual fund investments. Read the prospectus and speak to an IG Advisor before investing. The rate of return is the historical annual compounded total return as of December 31, 2025, including changes in value and reinvestment of all dividends or distributions. It does not take into account sales, redemption, distribution, optional charges or income taxes payable by any securityholder that would have reduced returns. Mutual funds are not guaranteed, values change frequently and past performance may not be repeated. Mutual funds and investment products and services are offered through the Mutual Fund Division of IG Wealth Management Inc. (in Quebec, a firm in financial planning). And additional investment products and brokerage services are offered through the Investment Dealer, IG Wealth Management Inc. (in Quebec, a firm in financial planning), a member of the Canadian Investor Protection Fund.

This commentary may contain forward-looking information which reflects our or third-party current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed herein. These risks, uncertainties and assumptions include, without limitation, general economic, political and market factors, interest and foreign exchange rates, the volatility of equity and capital markets, business competition, technological change, changes in government regulations, changes in tax laws, unexpected judicial or regulatory proceedings and catastrophic events. Please consider these and other factors carefully and do not place undue reliance on forward-looking information. The forward-looking information contained herein is current only as of December 31, 2025. There should be no expectation that such information will in all circumstances be updated, supplemented or revised whether as a result of new information, changing circumstances, future events or otherwise.

This commentary is published by IG Wealth Management. It represents the views of our Portfolio Managers and is provided as a general source of information. It is not intended to provide investment advice or as an endorsement of any investment. Some of the securities mentioned may be owned by IG Wealth Management or its mutual funds, or by portfolios managed by our external advisors. Every effort has been made to ensure that the material contained in the commentary is accurate at the time of publication, however, IG Wealth Management cannot guarantee the accuracy or the completeness of such material and accepts no responsibility for any loss arising from any use of or reliance on the information contained herein.

Trademarks, including IG Wealth Management and IG Private Wealth Management, are owned by IGM Financial Inc. and licensed to subsidiary corporations.

©2026 IGWM Inc.