Capital Group Global Developed Equity

Mandate commentary

Q4 2025

Highlights

① Global stocks rose modestly, as strong earnings and resilient U.S. growth offset AI valuation concerns, with major regions supported by improving economic conditions.

② Global growth strengthened as inflation eased, and policy turned supportive.

③ Equities and quality fixed income remain positioned for growth.

Mandate overview

In a quarter where global equities delivered positive returns, the mandate also advanced and was ahead of its benchmark, the MSCI World Index. Stock selection helped performance, while sector positioning weighed on results.

In a quarter where global equities delivered positive returns, the mandate also advanced and was ahead of its benchmark, the MSCI World Index. Stock selection helped performance, while sector positioning weighed on results.

Mandate: global equities rose during the quarter

Performance contributors

Information technology was the largest contributor to relative results, driven by stock selection. NVIDIA and ASML were leading contributors, benefiting from strong demand for AI-related chips, and software holdings also supported results.

Utilities were an area of strength, due to strong stock selection, particularly in multi-utilities, independent power and renewable electricity producers, and electric utilities companies. ENGIE was a standout performer, supported by positive sentiment toward its renewable energy strategy and new long‑term power purchase agreements signed with Meta Platforms, Apple and AstraZeneca.

Financials overall weighed on results, but Standard Chartered contributed positively after surpassing analysts’ expectations and raising its guidance on the back of strong performances in its wealth solutions and global banking businesses.

Performance detractors

Health care detracted due to weak stock selection and an underweight stance, with the absence of Eli Lilly proving costly, as the stock surged amid booming sales. AstraZeneca helped offset some of the weakness, outperforming after posting strong earnings, rapid oncology growth and positive sentiment around its drug pipeline.

Financials detracted from results, as a lighter footprint in banks and weaker stock selection in insurance and capital markets companies weighed on performance. London Stock Exchange Group was a notable detractor, with shares declining as sentiment toward its near‑term earnings outlook softened amid U.S. dollar weakness. This was followed by another pullback after the company reported a slowdown in second‑quarter subscription growth and reduced its annual subscription revenue target.

Cash holdings detracted in a rising market.

Total gross returns:

Total return | QTD | YTD | 1YR | 3YR | 5YR | SINCE INC. (FEB. 18, 2025) |

CAPITAL GROUP GLOBAL DEVELOPED EQUITY | 3.60%

| 17.66%

|

Mandate repositioning

Industrials remain the largest sector allocation, on an absolute basis, with continued emphasis on aerospace and defence companies, such as GE Aerospace, Safran and Rolls-Royce.

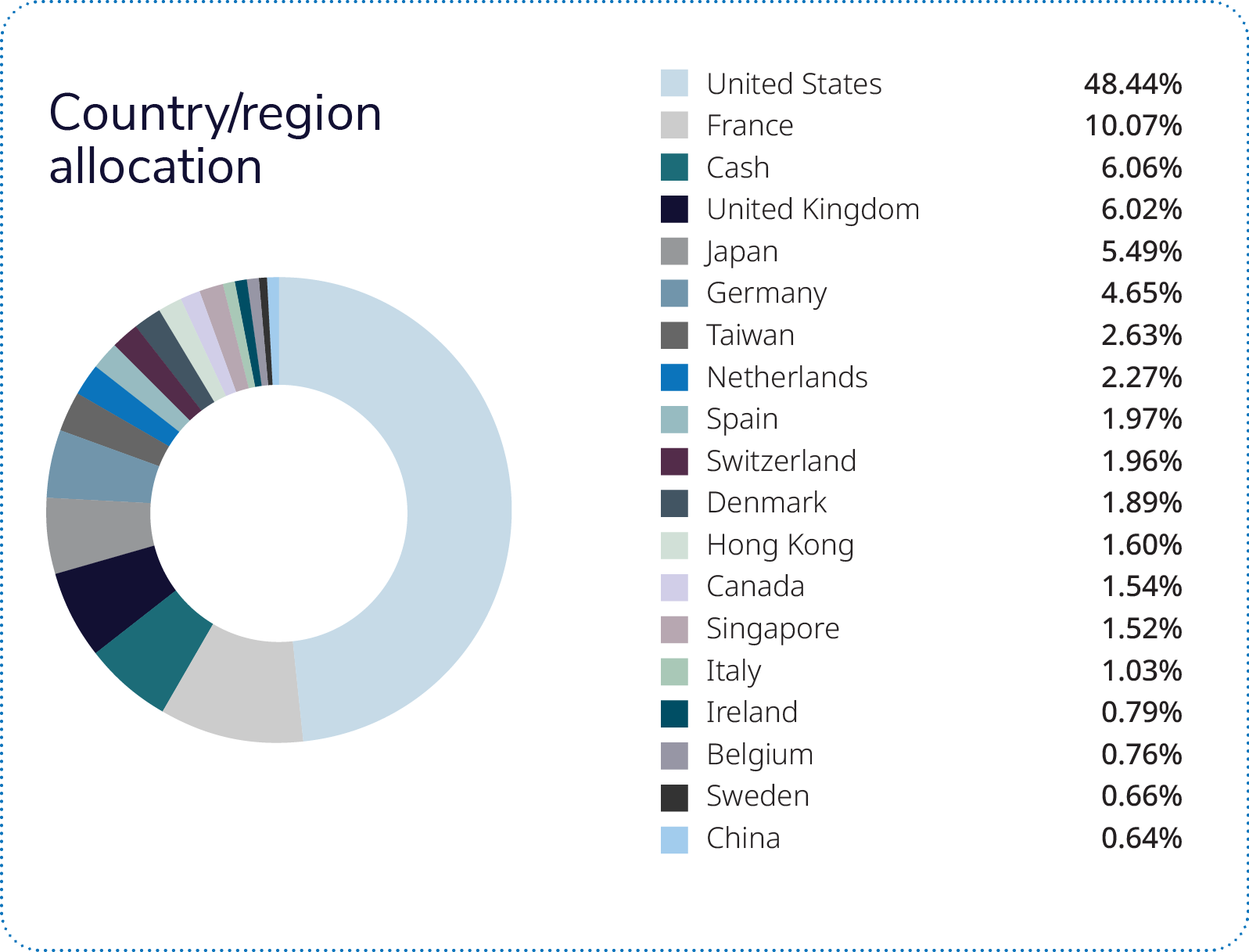

Technology represents the largest absolute portion of the portfolio but still has less allocation to the sector compared with the benchmark. Semiconductors and semiconductor‑equipment companies form the core of this exposure, with major holdings including Broadcom, TSMC, ASML, Microsoft, Apple and Fujitsu. Throughout the year and into the fourth quarter, managers continued to focus on leading global chip manufacturers and select software names aligned with long‑term AI and digital‑transformation trends.

Financials exposure remains below index weight but includes selective additions in banks and capital market firms.

Health care positions were trimmed during the year, with AbbVie among the notable reductions.

Communication services and consumer discretionary remain lighter than the index, though the portfolio retains conviction in select names, such as Alphabet, Meta Platforms and Royal Caribbean.

Cash levels remain modest at around 5.5%, as managers have tried to stay invested in a range of individual companies that they have found attractive.

Market overview: global growth strengthened, inflation eased, policy supportive

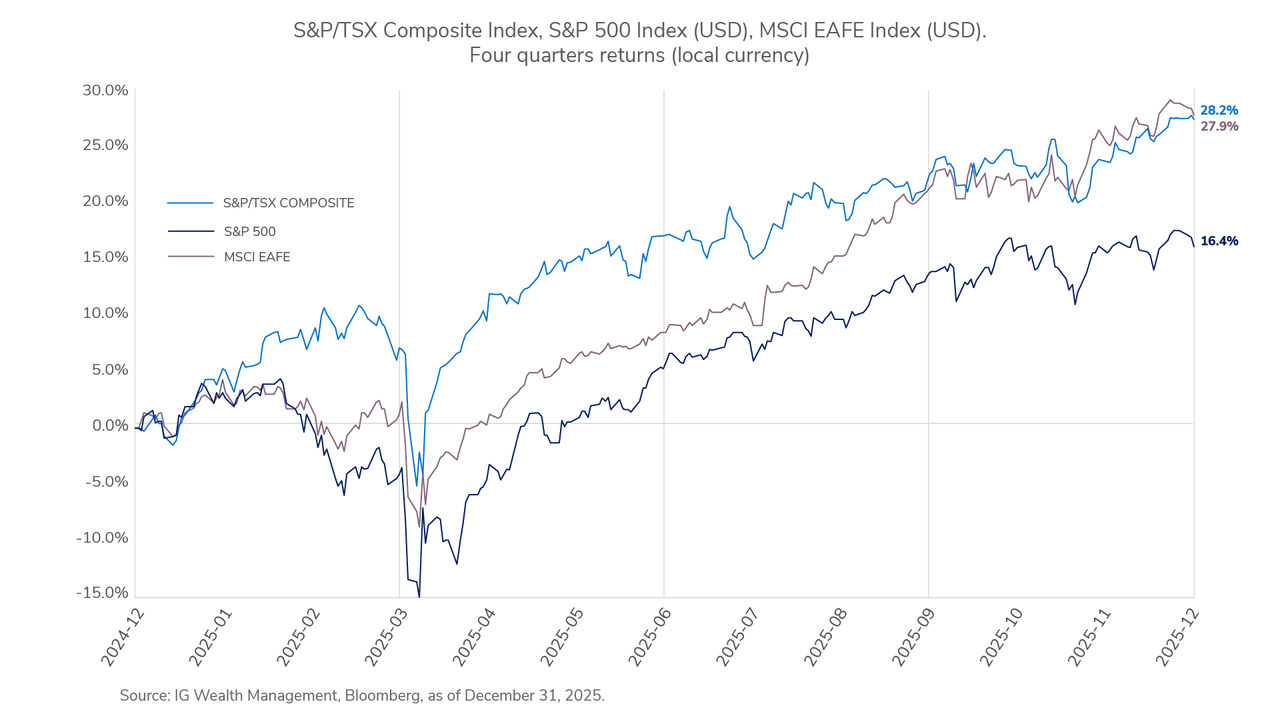

Markets ended the fourth quarter of 2025 on a strong note, capping a year defined by resilience and broad-based gains. Equities led performance, as investors looked beyond policy noise and focused on improving fundamentals. Global markets advanced, supported by steady corporate earnings, easing inflation pressures and a clear shift toward lower interest rates. Canada outperformed most developed peers, driven by strength in materials and financials, while European and Asian markets rebounded on firmer trade activity and renewed investor confidence. In the U.S., equity performance remained positive, led by technology and communication services, with improving breadth across sectors signalling a healthier market foundation.

Fixed income delivered modest but positive returns, as central banks continued to ease policy. Government yields declined on the short end while longer maturities remained stable, allowing coupon income to drive returns. Credit conditions stayed firm, underscoring the strength of corporate balance sheets entering 2026.

Market outlook: equities and quality fixed income positioned for growth

Entering 2026, global markets are positioned on a solid footing. Easing monetary policy and supportive fiscal conditions are expected to sustain growth across major economies. In the U.S., healthy earnings and productivity gains continue to anchor performance. Canada benefits from resource strength and steady financials, while Europe and Asia offer improving valuation opportunities through accelerating trade and industrial expansion. Fixed income markets provide renewed income potential as yields stabilize, and credit quality remains robust.

Overall, conditions favour a balanced, diversified approach.

To discuss your investment strategy, speak to your IG Advisor.

Azure Managed Investments™ provides discretionary investment management services distributed by IG Wealth Management Inc., Investment dealer. We will manage your Azure Managed Investments Accounts on a segregated basis in accordance with your investment policy statement and the resulting mandate selected by you. Mandates will be managed by I.G. Investment Management, Ltd. and partner organizations. You are required to make a minimum initial investment of $150,000; please read the Azure Managed Investment Account Agreement for complete details, including fees and expenses.

This commentary may contain forward-looking information, which reflects our or third-party current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed herein. These risks, uncertainties and assumptions include, without limitation, general economic, political and market factors, interest and foreign exchange rates, the volatility of equity and capital markets, business competition, technological change, changes in government regulations, changes in tax laws, unexpected judicial or regulatory proceedings and catastrophic events. Please consider these and other factors carefully and do not place undue reliance on forward-looking information. The forward-looking information contained herein is current only as of December 31, 2025. There should be no expectation that such information will in all circumstances be updated, supplemented or revised, whether as a result of new information, changing circumstances, future events or otherwise.

This commentary is published by IG Wealth Management. It is provided as a general source of information. It is not intended to provide investment advice or as an endorsement of any investment. Some of the securities mentioned may be owned by IG Wealth Management or its mutual funds, or by portfolios managed by our external advisors. It may contain certain forward-looking statements regarding the market conditions which are based upon assumptions believed to be reasonable at the time of publishing. Every effort has been made to ensure that the material contained in the commentary is accurate at the time of publication, however, IG Wealth Management cannot guarantee the accuracy or the completeness of such material and accepts no responsibility for any loss arising from any use of or reliance on the information contained herein.

Past performance may not be repeated and is not indicative of future results. Actual performance may vary due to a range of factors including but not limited to current market conditions, timing of contributions and withdrawals, client-imposed restrictions, fees, expenses, tax considerations and other individual circumstances. There are no assurances that any mandate will achieve its objectives and/or avoid any losses.

Trademarks, including IG Wealth Management and IG Private Wealth Management, are owned by IGM Financial Inc. and licensed to subsidiary corporations.

©2026 IGWM Inc.