Portfolio returns: Q4 2025

| Total Return | 1M | 3M | YTD | 1YR | 3YR | 5YR | 10YR | Since Inc. July 12, 2013 |

IG Core Portfolio – Growth F | -0.65

| 1.87

| 15.15

| 15.15

| 18.06

| 11.54

| 9.88

| 10.44

|

Quartile rankings | 2 | 2 | 2 | 2 | 2 | 2 | 2 |

| Total Return | 1M | 3M | YTD | 1YR | 3YR | 5YR | 10YR | Since Inc. July 12, 2013 |

IG Core Portfolio – Growth F | -0.65

| 1.87

| 15.15

| 15.15

| 18.06

| 11.54

| 9.88

| 10.44

|

Quartile rankings | 2 | 2 | 2 | 2 | 2 | 2 | 2 |

The IG Core Portfolio – Growth rose by 2.1% over the fourth quarter of 2025 and outperformed its Global Equity peer group median (0.8%). The portfolio benefited most from gains in Canadian and international equities.

The IG Core Portfolio – Growth rose by 2.1% over the fourth quarter of 2025 and outperformed its Global Equity peer group median (0.8%). The portfolio benefited most from gains in Canadian and international equities.

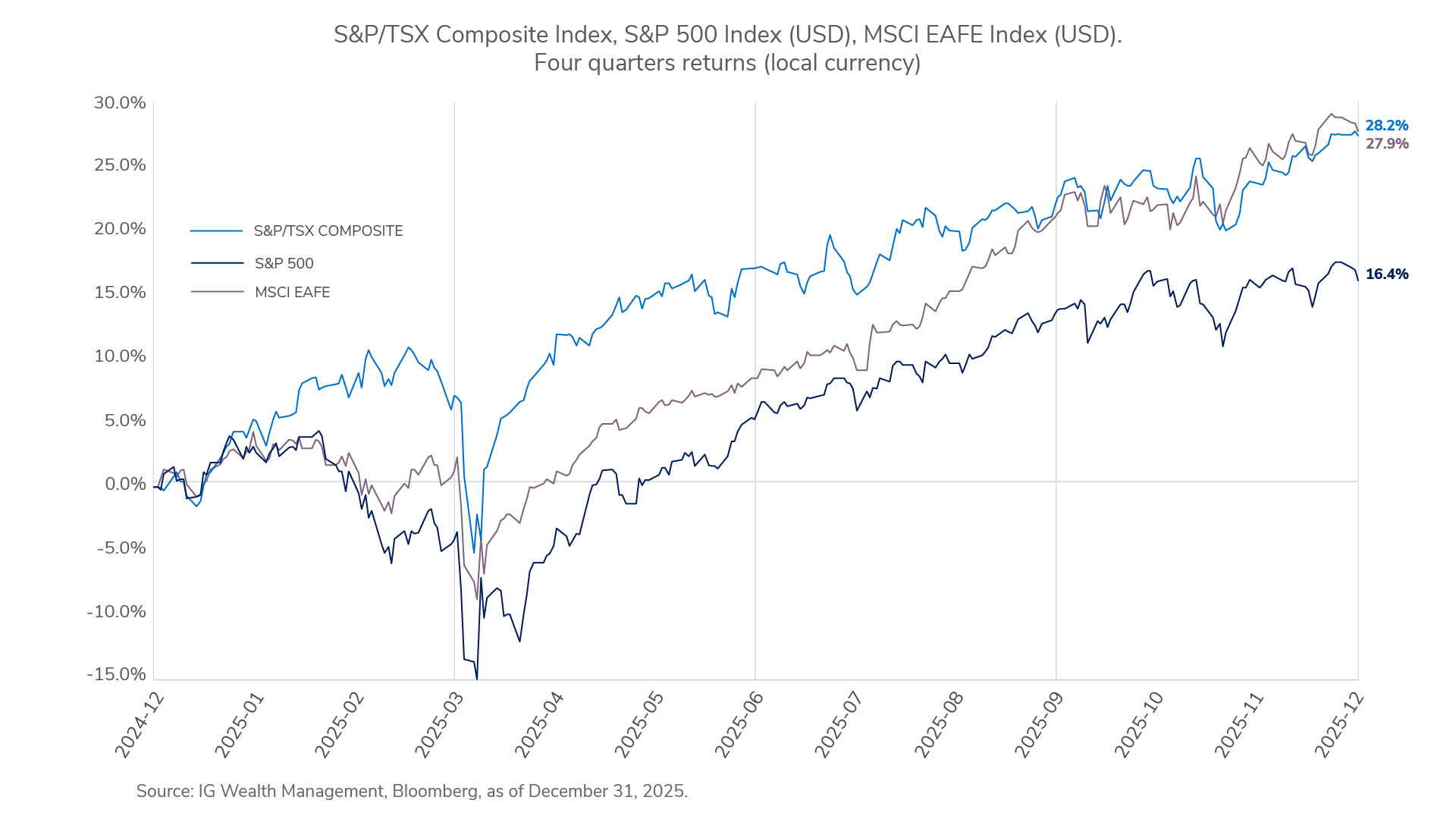

Many equity indices, including the S&P 500 Index (total return 1.1% in Canadian dollars), the S&P/TSX Composite Index (total return 6.3% in Canadian dollars) and the Dow Jones Industrial Average Index (total return 2.3% in Canadian dollars) initially dropped, following their record high performance in Q3 2025, but recovered to deliver positive results in the fourth quarter. Most other global markets were also higher during the fourth quarter of 2025, supported by continued resilience in economic activity and improved investor confidence. Market sentiment benefited from easing trade-related uncertainty and signs of stabilization in global supply chains. Meanwhile, economic data, mainly in the U.S., remained broadly supportive. Moderating inflation trends allowed several major central banks, including the U.S. Federal Reserve, the Bank of Canada and the Bank of England, to adopt a more accommodative policy stance, reinforcing expectations for lower interest rates. Against this backdrop, equity markets advanced steadily over this quarter, contributing positively across the portfolio’s equity allocations.

Positive performance was driven primarily by strong results from Canadian and international equity mandates. The Mackenzie-IG Canadian Equity Pool was the top individual contributor, reflecting both strong absolute performance and its meaningful portfolio weight. Additional positive contributions came from the Fidelity-IG Canadian Equity Pool, IG Mackenzie European Equity Strategies, the JPMorgan-IG Emerging Markets Pool and diversified allocations within the BlackRock-IG Active Allocation Pool II.

However, several allocations detracted from performance over the period. The most significant drag came from the Mackenzie-IG U.S. Equity, which posted a slightly negative return and weighted heavily on results due to its considerable portfolio weight. Additional headwinds stemmed from the IG Mackenzie Global Fund and IG Mackenzie Pan Asian Equity Fund, both of which recorded negative performance. Smaller but still noticeable detractors included the Aristotle U.S. Small Cap Equity Pool and the Wellington-IG Global Equity Hedge Pool. The Aristotle-IG U.S. Small Equity Pool results were consistent with the broader market environment in Q4, where small caps underperformed large caps. The Wellington-IG Global Equity Hedge Pool is an alternative strategy intended to provide a steadying influence when used as a diversifying component of broader portfolios and is not expected to outperform during periods of strong global equity performance.

Markets ended the fourth quarter of 2025 on a strong note, capping a year defined by resilience and broad-based gains. Equities led performance, as investors looked beyond policy noise and focused on improving fundamentals. Global markets advanced, supported by steady corporate earnings, easing inflation pressures and a clear shift toward lower interest rates. Canada outperformed most developed peers, driven by strength in materials and financials, while European and Asian markets rebounded on firmer trade activity and renewed investor confidence. In the U.S., equity performance remained positive, led by technology and communication services, with improving breadth across sectors signalling a healthier market foundation.

Fixed income delivered modest but positive returns, as central banks continued to ease policy. Government yields declined on the short end while longer maturities remained stable, allowing coupon income to drive returns. Credit conditions stayed firm, underscoring the strength of corporate balance sheets entering 2026.

Investors today face a familiar challenge: distinguishing meaningful economic signals from the constant noise that surrounds the market. While headlines continue to highlight pockets of uncertainty, from uneven labour trends to temporary slowdowns in specific sectors, the broader picture is far more constructive. The underlying fundamentals remain resilient, and as we enter 2026, clarity is emerging not from the absence of volatility, but from the strength of the economic foundation beneath it.

The economic cycle is still intact and evolving, supported by a combination of monetary easing, ongoing fiscal expansion, rapid advances in AI‑driven productivity and the durability of the consumer. These forces are not speculative; they are measurable developments that continue to shape a stable and supportive backdrop for markets. At the same time, corporate fundamentals remain solid, reflecting the adaptability and efficiency that have defined this stage of the cycle. Collectively, these pillars provide a robust foundation for the year ahead, underscoring a market environment driven by structural strength rather than short‑term volatility.

Commissions, fees and expenses may be associated with mutual fund investments. Read the prospectus and speak to an IG Advisor before investing. The rate of return is the historical annual compounded total return as of December 31, 2025, including changes in value and reinvestment of all dividends or distributions. It does not take into account sales, redemption, distribution, optional charges or income taxes payable by any securityholder that would have reduced returns. Mutual funds are not guaranteed, values change frequently and past performance may not be repeated. Mutual funds and investment products and services are offered through the Mutual Fund Division of IG Wealth Management Inc. (in Quebec, a firm in financial planning). And additional investment products and brokerage services are offered through the Investment Dealer, IG Wealth Management Inc. (in Quebec, a firm in financial planning), a member of the Canadian Investor Protection Fund.

This commentary may contain forward-looking information which reflects our or third-party current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed herein. These risks, uncertainties and assumptions include, without limitation, general economic, political and market factors, interest and foreign exchange rates, the volatility of equity and capital markets, business competition, technological change, changes in government regulations, changes in tax laws, unexpected judicial or regulatory proceedings and catastrophic events. Please consider these and other factors carefully and do not place undue reliance on forward-looking information. The forward-looking information contained herein is current only as of December 31, 2025. There should be no expectation that such information will in all circumstances be updated, supplemented or revised whether as a result of new information, changing circumstances, future events or otherwise.

This commentary is published by IG Wealth Management. It represents the views of our Portfolio Managers and is provided as a general source of information. It is not intended to provide investment advice or as an endorsement of any investment. Some of the securities mentioned may be owned by IG Wealth Management or its mutual funds, or by portfolios managed by our external advisors. Every effort has been made to ensure that the material contained in the commentary is accurate at the time of publication, however, IG Wealth Management cannot guarantee the accuracy or the completeness of such material and accepts no responsibility for any loss arising from any use of or reliance on the information contained herein.

Trademarks, including IG Wealth Management and IG Private Wealth Management, are owned by IGM Financial Inc. and licensed to subsidiary corporations.

©2026 IGWM Inc.