Portfolio returns: Q4 2025

| Total Return | 1M | 3M | YTD | 1YR | 3YR | 5YR | 10YR | Since Inc. (Apr 19, 2022) |

IG Mackenzie U.S. Dollar Fund – Global Equity F | 0.08

| 1.55

| 14.38

| 14.38

| 17.24

| 11.03

| ||

Quartile rankings | 3 | 3 | 3 | 3 | 2 |

| Total Return | 1M | 3M | YTD | 1YR | 3YR | 5YR | 10YR | Since Inc. (Apr 19, 2022) |

IG Mackenzie U.S. Dollar Fund – Global Equity F | 0.08

| 1.55

| 14.38

| 14.38

| 17.24

| 11.03

| ||

Quartile rankings | 3 | 3 | 3 | 3 | 2 |

The IG Mackenzie U.S. Dollar Fund – Global Equity generated a positive return against the backdrop of a strong U.S. equity market, although it underperformed its benchmark.

The IG Mackenzie U.S. Dollar Fund – Global Equity generated a positive return against the backdrop of a strong U.S. equity market, although it underperformed its benchmark.

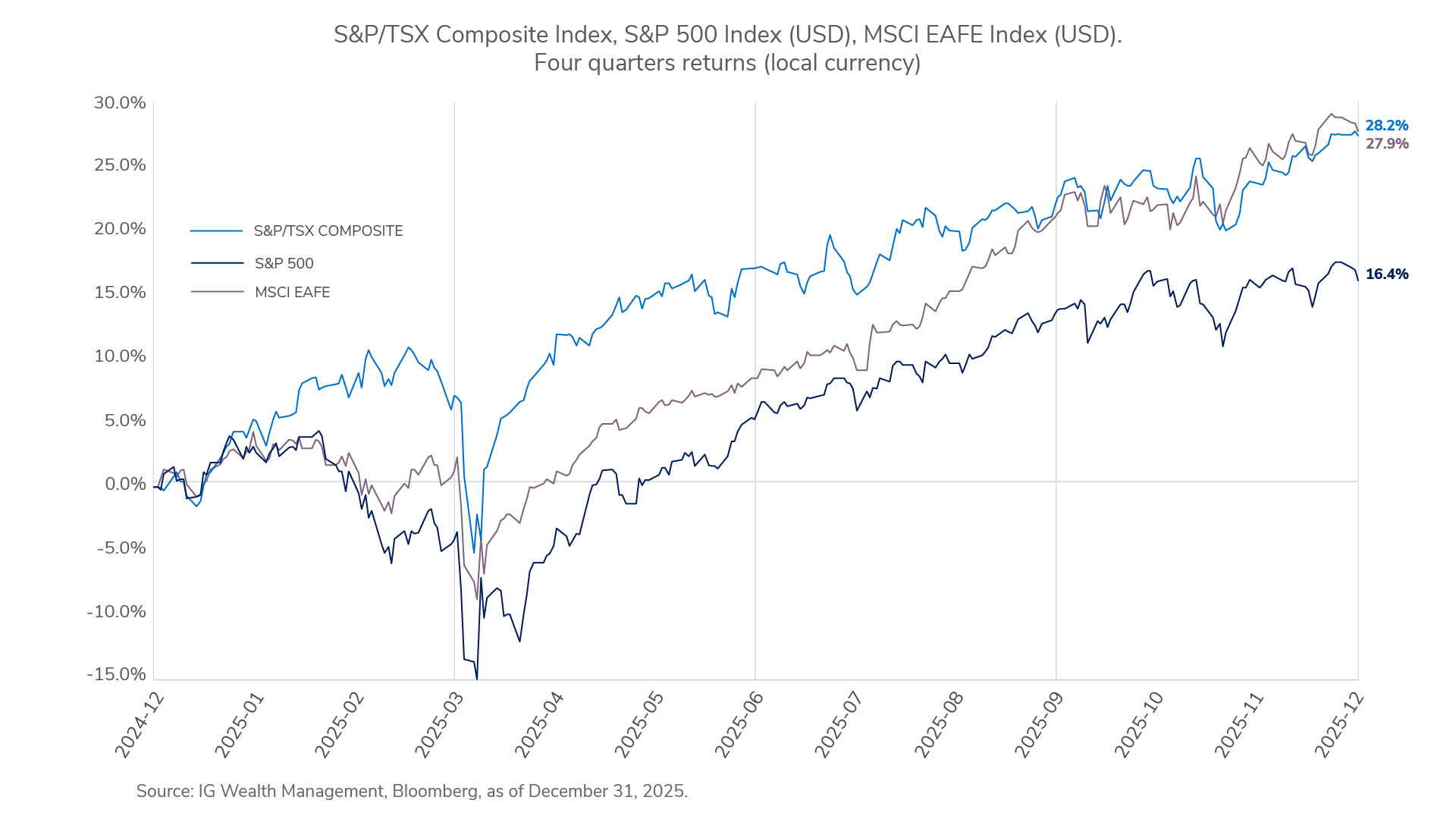

Global markets delivered positive returns in Q4 2025, as easing inflation and stable financial conditions, coupled with broadly supportive corporate results, helped maintain investors’ risk-on sentiment. Equity performance was positive across most regions, with a few exceptions, such as China, which lagged amid ongoing economic and policy challenges. Canadian equities outperformed U.S. markets, supported by a strong performance in cyclical sectors, including materials, financials and consumer discretionary, reflecting continued global risk appetite. The Canadian dollar strengthened against major currencies, resulting in lower unhedged returns for Canadian investors. Lower-priced, value-oriented companies outperformed high-growth companies across global and North American markets. In commodities, gold and silver performed exceptionally well amid lingering macroeconomic and geopolitical risks and strong investor demand, while oil prices declined on concerns over excess supply.

Within this economic and market backdrop, the IG Mackenzie U.S. Dollar Fund – Global Equity posted a positive return, although it underperformed its benchmark. Health care and communication services sectors contributed to its positive performance. Security selection in industrials and information technology and selection in U.S. holdings contributed to the relative underperformance.

Additionally, the fund’s 100% U.S. dollar currency-hedging policy detracted from returns, as the U.S. dollar underperformed other major foreign currencies.

Markets ended the fourth quarter of 2025 on a strong note, capping a year defined by resilience and broad-based gains. Equities led performance, as investors looked beyond policy noise and focused on improving fundamentals. Global markets advanced, supported by steady corporate earnings, easing inflation pressures and a clear shift toward lower interest rates. Canada outperformed most developed peers, driven by strength in materials and financials, while European and Asian markets rebounded on firmer trade activity and renewed investor confidence. In the U.S., equity performance remained positive, led by technology and communication services, with improving breadth across sectors signalling a healthier market foundation.

Fixed income delivered modest but positive returns, as central banks continued to ease policy. Government yields declined on the short end while longer maturities remained stable, allowing coupon income to drive returns. Credit conditions stayed firm, underscoring the strength of corporate balance sheets entering 2026.

Our outlook for equities in 2026 remains positive, supported by strong corporate earnings and a resilient U.S. economy. However, we expect higher volatility than in 2025, as the second year of a U.S. presidential term has historically been more volatile. Within equities, we have increased our allocation to Canadian stocks, supported by resilient economic data and upward earnings revisions. We continue to find attractive valuations in Japan and EAFE and maintain a neutral view for the U.S.

In currencies, our long-term view is for the U.S. dollar to depreciate against major currencies, including the euro and Japanese yen.

Commissions, fees and expenses may be associated with mutual fund investments. Read the prospectus and speak to an IG Advisor before investing. The rate of return is the historical annual compounded total return as of December 31, 2025, including changes in value and reinvestment of all dividends or distributions. It does not take into account sales, redemption, distribution, optional charges or income taxes payable by any securityholder that would have reduced returns. Mutual funds are not guaranteed, values change frequently and past performance may not be repeated. Mutual funds and investment products and services are offered through the Mutual Fund Division of IG Wealth Management Inc. (in Quebec, a firm in financial planning). And additional investment products and brokerage services are offered through the Investment Dealer, IG Wealth Management Inc. (in Quebec, a firm in financial planning), a member of the Canadian Investor Protection Fund.

This commentary may contain forward-looking information which reflects our or third-party current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed herein. These risks, uncertainties and assumptions include, without limitation, general economic, political and market factors, interest and foreign exchange rates, the volatility of equity and capital markets, business competition, technological change, changes in government regulations, changes in tax laws, unexpected judicial or regulatory proceedings and catastrophic events. Please consider these and other factors carefully and do not place undue reliance on forward-looking information. The forward-looking information contained herein is current only as of December 31, 2025. There should be no expectation that such information will in all circumstances be updated, supplemented or revised whether as a result of new information, changing circumstances, future events or otherwise.

This commentary is published by IG Wealth Management. It represents the views of our Portfolio Managers and is provided as a general source of information. It is not intended to provide investment advice or as an endorsement of any investment. Some of the securities mentioned may be owned by IG Wealth Management or its mutual funds, or by portfolios managed by our external advisors. Every effort has been made to ensure that the material contained in the commentary is accurate at the time of publication, however, IG Wealth Management cannot guarantee the accuracy or the completeness of such material and accepts no responsibility for any loss arising from any use of or reliance on the information contained herein.

Trademarks, including IG Wealth Management and IG Private Wealth Management, are owned by IGM Financial Inc. and licensed to subsidiary corporations.

©2026 IGWM Inc.